I hope you would have heard

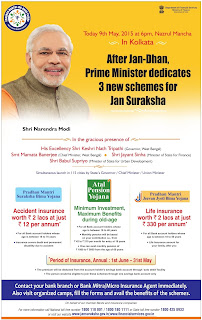

about the new social security schemes including two mass insurance schemes launched by our central government [Ref].

- Pradhan Mantri Suraksha Bima Yojana: Accident insurance

- Pradhan Mantri Jeevan Jyoti Yojana: Life insurance

- Atal Pension Yojana: Pension plan

I have

gone through the policy details and find that the insurance schemes are very good. I

suggest you can consider these policies and subscribe for both insurance

schemes, unless you are already sufficiently insured.

One major benefit is its simplicity. Premium will be auto-debited from the bank account, so it will continue forever (as long as you have sufficient balance).

Currently almost all banks are

providing subscription facility by sending SMS. These policies can be taken from

any bank but SMS details of all banks are different. SMS details for ICICI (to

be sent from registered mobile number) are as follows:

PMSBY NOMINEE NAME Y --> Send

to 5676766 (Accident insurance; premium Rs 12)

PMJJY NOMINEE NAME Y --> Send

to 5676766 (Life insurance; premium Rs 330)

I confirmed from the branch and they informed that since policy is effective from June 1st for those who send sms by May

31st, policy document will be ready in about 15 days after June 1st and we

shall be able to download it from ICICI Bank website, perhaps from insurance

tab.

If you heard PM Modi on TV speaking

from Bengal while launching it; the main attraction of this insurance policy is

that it can be taken by anyone, even by a person on deathbed or having a

terminal illness. This is how this policy is different! Mainly because it is

launched by govt.

I think claim process will be similar to the ones we have

for other insurance policies; we have to contact the insurance company.

Someone asked if it matters

which bank we take the policy from. From what I have read, this will indeed

make a different, as a customer friendly or unfriendly bank or its associated

general insurance company will behave with us like they behave with other

customers – customers of this scheme won’t be treated differently or

preferentially.

Someone asked if these polices

have any drawback. The only concern as it appears is that suppose there is a

Govt change at the center after 5 years and next govt discontinues it- then

what happens. But since both these schemes are kind of term insurance, i.e. you

get insurance until you keep paying premium, even if it covers us for 5 years;

what do we lose? We don’t lose anything but we are insured for the years it is

active in case of any eventuality. So I think we should definitely subscribe

since both are at very cheap rate of premium.

Also, while Atal Pension Yojna/plan

is only for unorganized sector; insurance schemes are for all. Because pension

and insurance are different. People in the organized sector already have either

PF or pension and hence don’t need Atal pension plan. But when it comes to

insurance, both organized and unorganized sector employees lack it – also

because regular insurance is costly; and hence govt launched these two

insurance schemes which are for all no matter in organized or unorganized

sector…

My recommendation is that we

should definitely take these policies (if we meet the eligibility).

Disclaimer: Views expressed are

personal.

No comments:

Post a Comment